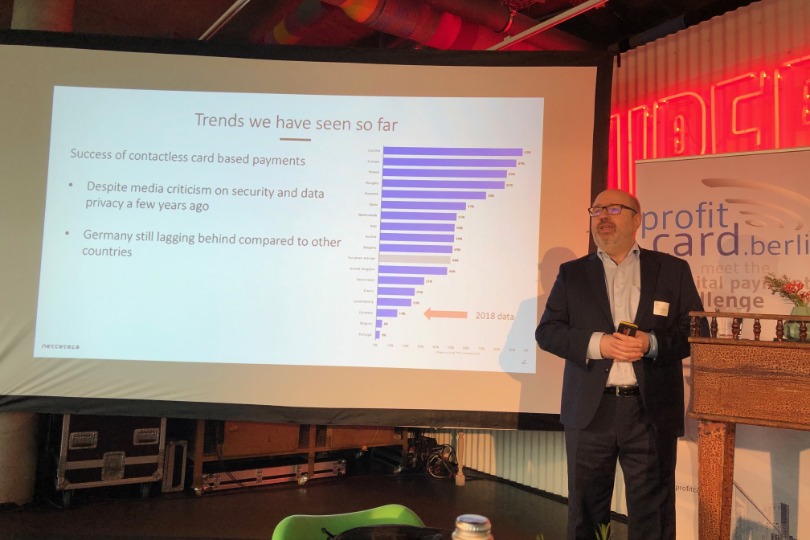

For the Swiss software company Netcetera the intensive study of such questions is of fundamental importance. After all, it is about actively shaping the future of payment. Trend scouting is a proven method for a structured approach. Kurt Schmid, Managing Director Digital Payment at Netcetera, coined the term "payspectives" in connection with payment. He explained his findings at the ProfitCard conference in Berlin.

The starting point are the trends, which can already be clearly identified. For example, contactless payments with cards are very advanced, despite initial strong criticism of security and data protection in many media. Equally impressive are the successes of mobile payments - especially in connection with wallets like Apple Pay. The use of biometrics for authentication and the opening of bank interfaces through PSD2 also play an important role. In addition, there are other trends, such as the strong growth in online payment, merchant apps with integrated payment and, finally, continuous improvements in user-friendliness for all electronic payment methods.

Clearly recognizable trends vs. ideas without breakthrough

There are also ideas that have not yet achieved a breakthrough. Examples include the topics "Blockchain for standard payments", "payment with wearables", "payment in the Internet of Things (IoT)" or "cashless supermarkets" such as Amazon Go.

In order to delve into all these topics, Netcetera also organized a workshop at ProfitCard. The idea was to summarize the trends in clusters to give the discussions a meaningful structure. The cluster titles: card related (e.g. European scheme, 3DS 2.x), KYC related (e.g. eIDAS, FIDO), technology related (e.g. tokenization, delegated authentication, Blockchain), UX & functional (e.g. in-app payment, pay by face), ecosystem related (e.g. bank as platform provider, GAFAs as partners), account related (e.g. instant payments). Kurt Schmid: "With this, we have hit the nerve of the participants. They all worked intensively with great interest and commitment.

To the ProfitCard Presentation on SlideShare:

- Kurt Schmid, Managinig Director Digital Payments: Payment Trend Scouting